5 Stocks Poised For Dividend Increases In 2015

5 Stocks Poised For Dividend Increases In 2015

Stocks to consider buying before they raise their dividends

by Michael Fowlkes

Over the next two weeks, most of us will have plenty to think about besides investing. But once all the presents have been opened, and the New Years Eve has come and gone, 2015 will get under way and our focus must shift back to our portfolios. A great way to get a head start of 2015 is by looking for stocks that will announce dividend increases soon after the new year.

January tends to be a good month on Wall Street. Between bonus checks that need to be invested, money that needs to be reinvested from December tax selling, and holiday gifts that get deposited to trading accounts, January is usually a strong month.

A good place to begin your search for a stock is the following list of stocks which are likely to increase their dividends early in the new year. Dividend stocks tend to be more stable than non-dividend stocks, and those that have proven an ability to increase dividends are an even safer bet.

When companies demonstrate a commitment to maintaining their dividend program, it is a symbol of strength in the underlying business. When companies increase dividends, it is a show of confidence on the part of management that the company will not only be able to maintain its current program, but grow enough to accommodate the higher dividend as well. This is why a lot of times stocks will enjoy a little boost after news of a dividend increase.

There are typically a few weeks between when a stock announces a dividend and when the stock trades ex-dividend (the last day which you can buy the stock and still get the distribution), and it is during this time period when stocks can sometimes enjoy a little boost.

Not only are each of the following stocks likely to announce dividend increases early in 2105, but all five are in upwards trends and have strong technical trends.

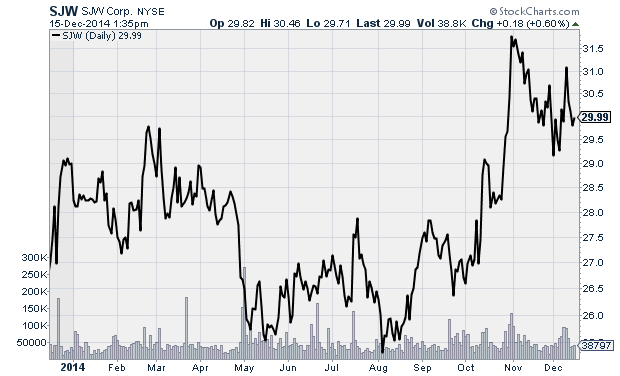

SJW Corp.

SJW Corp. (SJW) is a water utility company, with a current dividend yield of 2.5%. Like almost all utilities, SJW has always been a solid dividend payer, and the company boasts an impressive 46-year streak of dividend increases. With a payout ratio of just 29.8%, it is almost a given that the company will extend its streak of dividend increases when it announces its next dividend in late-January. While an increase is practically guaranteed, it will not be a very big one. The last two years, the company has boosted its dividend by 2.8%, and I would not look for this year's increase to vary too much from the last two. SJW's quarterly distribution is currently $0.1875 per share, which I expect to rise to around $0.1925. The increase should be announced close to the end of January, with shares trading ex-dividend a week following the announcement, and the distribution payable during the first week of March.

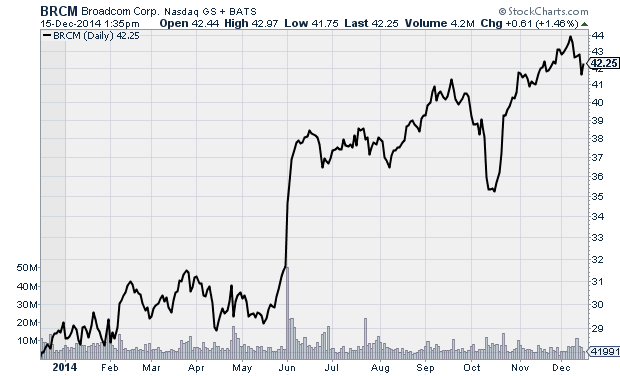

Broadcom Corp.

Broadcom Corp. (BRCM) does not have the most impressive streak of dividend increases, but with a very low 21.5% payout ratio, the company can easily afford to build on its four-year streak of increases. The stock currently has a dividend yield of just 1.1%, but that is likely to move slightly higher when it announces its next dividend during the final week of January. Previous increases have been relatively modest; last year the quarterly distribution increasing 9.0%, and the previous year 10%. This year I expect the quarterly payment to rise from $0.11 to $0.12, which would translate to an increase of 9%. Look for the stock to trade ex-dividend mid-February, with the dividend payable during the first week of March.

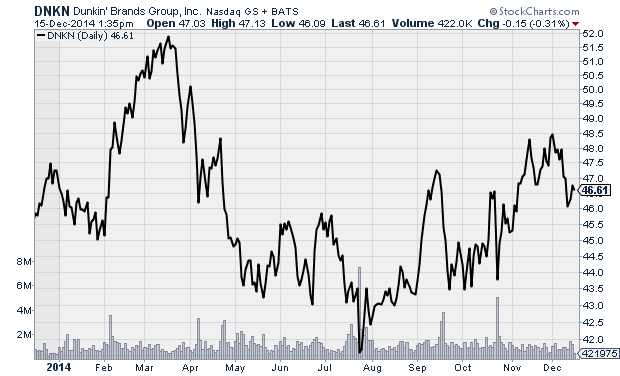

Dunkin' Brands Group, Inc.

Dunkin' Brands Group, Inc. (DNKN) will likely announce a dividend increase towards the end of January, or possible the first week of February. DNKN currently has a yield of 2.0%, and a two-year streak of increases. The company just began paying dividends in 2012, and each of the last two years it has made significant increases to its quarterly distribution. Last year it hiked its quarterly payment by 21%, and the previous year's increase was an even larger 26.7%. Its payout ratio is currently sitting at 52.3%, so it can easily afford another increase, but maybe not as big as the last two. The quarterly distribution is now $0.23 per share, which I expect the company to lift to $0.27, which would mark a 17.4% increase. The stock should trade ex-dividend early-March, with the distribution payable around two weeks after the ex-dividend date.

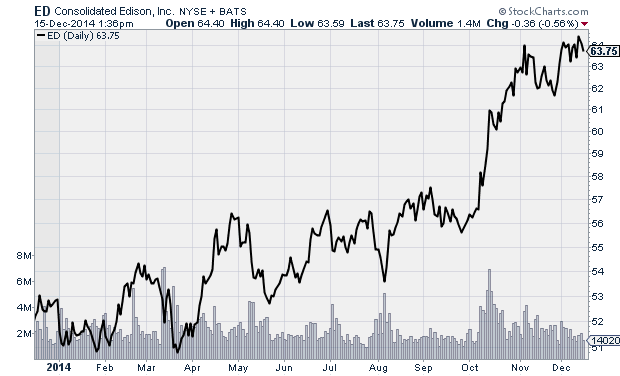

Consolidated Edison

Electric utility company Consolidated Edison, Inc. (ED)'s dividend yield is currently sitting at 4.0%, and with a quarterly dividend payment of $0.63 per share. Not only does the company offer a large dividend yield, it also boasts an impressive 39-year streak of dividend increases. The company's payout ratio is a bit high at 65.3%, but with the chance to enter into the exclusive group of stocks with dividend streaks of at least 40 years, there is very little chance that it would miss that opportunity by not increasing its dividend again next year. The company tends to announce its annual dividend increases during the middle of January, which is when I expect the next increase to be announced. Last year the company boosted its dividend by 2.5%, and the previous year the increase was just 1.6%. With the stock already paying a 4.0% yield, and with a payout ratio of around 65%, I would expect another small increase this year. Look for Consolidated Edison to boost its quarterly payment from $0.63 to $0.645, which would translate to a 2.4% increase. Look for the announcement mid to late January, with the stock trading ex-dividend mid-February, with the distribution payable mid-March.

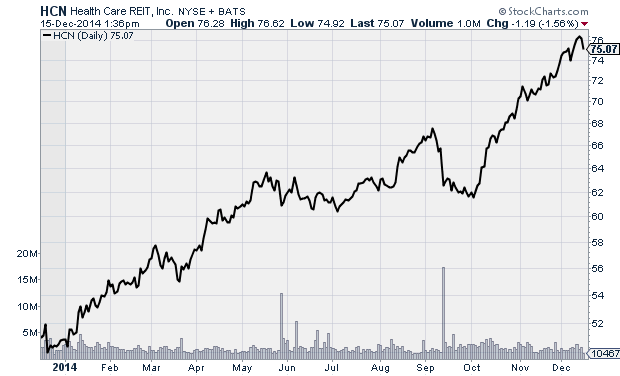

Health Care REIT, Inc.

Health Care REIT, Inc. (HCN) has boosted its dividend each of the last four years, a streak which it is likely to extend when it announces its next dividend toward the end of January. Since HCN operates as a REIT, it is required to distribute at least 90% of its earnings in the form of shareholder distributions in order to keep its tax advantage, so investors should expect another increase at some point in late January. The stock currently pays a quarterly dividend of $0.795, which is up 3.9% from where it was last year. Look for the company to lift the dividend to around $0.825, which would equate to a 3.8% increase. The news should come during the last week of January, with the stock trading ex-dividend around a week later. The higher distribution will be payable during the latter part of February.

Courtesy of MarketIntelligenceCenter.com