5 Big Name Stocks With Reasonable Valuations

Five stocks that look undervalued

by Michael Fowlkes

One of the hardest things to do in both investing and our everyday lives is finding a good value. The reason it is so difficult to find a good value is that in most cases "value" can be very subjective.

The value you put on the car sitting in your driveway may be well above or below the value I would put on that car. Investing is no different. One person will view a stock as being overpriced, while another will believe that the stock is cheap. As they say, one man's trash is another man's treasure. That is just as true in investing as anything else in life.

So how can we begin to discuss stocks that are "undervalued"? The most common way to judge a stock's valuation is by looking at where the security is trading in relation to the amount of money the company earns per share. This is known as the price-to-earnings ratio, and is where we will begin our search for undervalued stocks.

A good rule of thumb is that most stocks should trade somewhere between 17 and 25 times earnings. When you see a P/E below 17 you can begin assuming it may be undervalued, and likewise when you see a P/E in the upper 20's you can initially assume that the stock is overbought.

In addition to the current P/E ratio, we prefer to look at two other attributes of a stock before reaching your decision on its current value. You want to look at expected earnings growth, and how the stock's P/E compares with its peers. High forecast earnings growth and a favorable comparison to its peers indicates that the stock is likely to appreciate quicker than other companies in its sector, and is a buy indicator.

Let's take a look at five stocks that currently appear to be undervalued based on these factors:

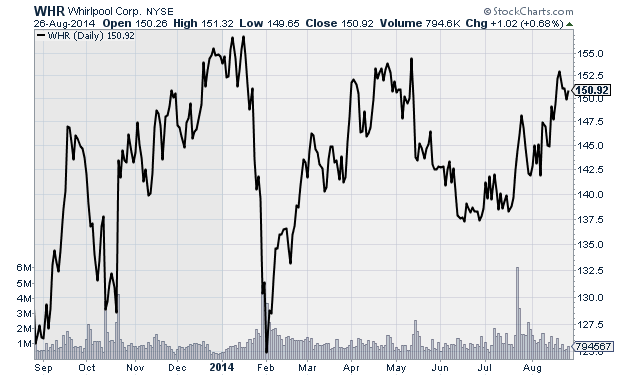

Whirlpool (WHR)

Appliance manufacturer Whirlpool (WHR) looks a bit undervalued at the current time, with a P/E ratio of just 16.5. While there is no direct competitor trading on the U.S. exchange to compare Whirlpool to (Samsung would be perfect if it traded in the U.S.), we can compare Whirlpool to General Electric (GE), which has a P/E of 19. Despite not having a direct peer to put Whirlpool up against, we can still determine that WHR is undervalued when we look at forward earnings estimates, which are for 19% earnings growth next year. Even if the stock maintains its current valuation, the stock will have to rise in order to maintain the same P/E ratio as earnings increase. Improvements in the overall economy and in the housing market have led to impressive earnings growth for Whirlpool over the last few years, and if the company's future earnings live up to expectations, the stock should continue trending higher over the next twelve months

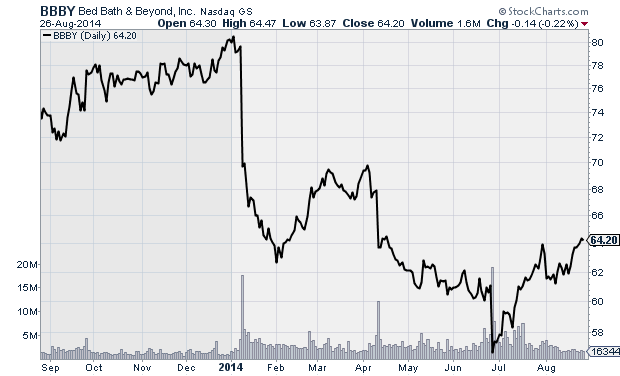

Bed Bath & Beyond (BBBY)

Home furnishing retailer Bed Bath & Beyond (BBBY) is currently trading with an attractive P/E ratio of just 13. By comparison, another leader in the home-furnishing sector, Pier 1 (PIR), trades at a higher valuation of 16. The company's earnings growth has come under pressure in the last two quarters, with no earnings growth last quarter, and a 4.8% year-over- year decline the previous quarter. Analysts are optimistic regarding future earnings growth, and have forecast 9% growth next year. Improvements in the housing market should result in higher earnings, and keep strength under BBBY shares moving forward.

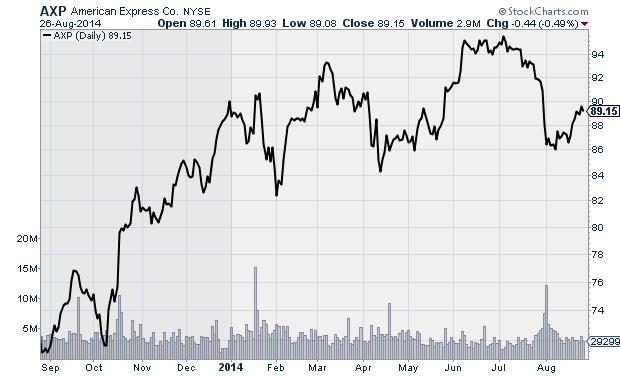

American Express (AXP)

Payment processor American Express (AXP) has enjoyed strong earnings growth over the last year, and analysts expect more of the same moving forward, with forward estimates calling for earnings growth of 10% next year. The stock ran into a bit of trouble towards the end of July with the overall market, but a better-than-expected second-quarter report at the end of the month helped the stock find a solid level of support and it is once again trending higher. The stock looks a bit undervalued, with a P/E of 17.6, compared to competitors Visa (V) and MasterCard (MA) with P/E ratios of 25 and 29 respectively. American Express is benefitting from improvements in the overall economy, and if earnings grow at the rate analysts expect moving forward, AXP stock should continue building on its recent momentum.

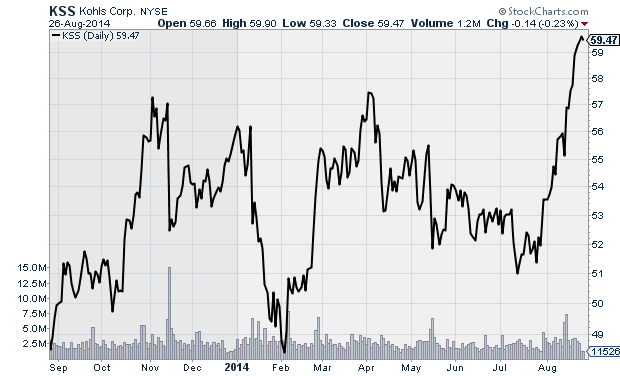

Kohl's (KSS)

Retailer Kohl's (KSS) has a P/E ratio of 14.8. For comparison purposes, TJX Companies (TJX) has a P/E of 20, while Macy's (M) is trading with a P/E of 16. After three quarters of declining earnings, the company got back on track last quarter, reporting an 8.7% rise in earnings compared the same period last year. Consumer confidence is on the rise, and hit a seven-year high in August, which bodes well for retailers moving forward. Looking ahead, analysts expect 10% earnings growth next year, which should keep strength under the stock, and allow shares to build on recent momentum.

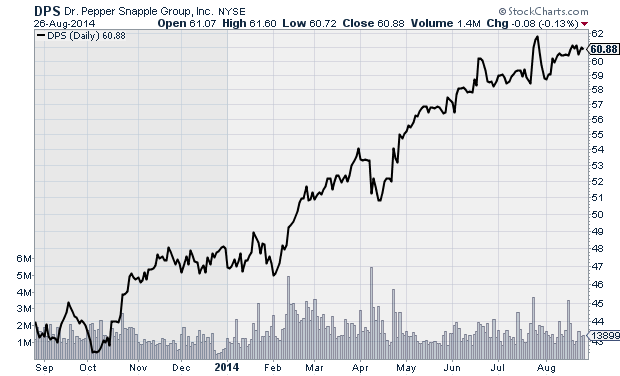

Dr. Pepper Snapple Group (DPS)

Beverage manufacturer Dr. Pepper Snapple Group (DPS) has shown year-over-year earnings growth each of the last four quarters, and analysts expect that trend to continue moving forward. The stock is currently trading with a P/E of 18, and with analysts forecasting 6% earnings growth next year, the stock should continue trending higher. By comparison, Dr. Pepper's biggest competitors, Pepsi (PEP) and Coca-Cola (KO) have P/E ratios of 21 and 22 respectively, so there is reason to believe that DPS stock has more upside potential. Dr. Pepper has outpaced analyst estimates for the last four quarters, which has resulted in steady stock gains, and if the company is able to live up to future expectations the stock will continue trending higher.

Courtesy of MarketIntelligenceCenter