5 Retail Stocks Worth A Look Here

Five values in the retail sector

Investing is not unlike other aspects of our day-to-day lives in that we are constantly seeking to find a good value. However, unlike actual tangible assets, it is not so easy to know when a stock is trading at a good value.

There are a variety of metrics we can use as investors to determine whether or not a stock is priced at or below its fair value, but the most widely accepted metric is price-to-earnings ratio, also known the P/E ratio.

Because consumer spending plays such a vital role to the nation's GDP, the retail sector garners a lot of attention on Wall Street. The recession took its toll on most retailers, but the economic landscape has improved a lot since the recession, and consumers have become increasingly optimistic.

The Conference Board Consumer Confidence Index in June showed that consumer confidence has risen to its highest level since 2008, which should translate to higher retail sales, and benefit retailers in all sectors.

However, even with the recent rise in consumer confidence, not all retail stocks (XRT) have been strong. In some cases, recent weakness opens the door for opportunistic investors to swoop in and grab shares at a big discount. Even in the case of stocks, which have been strong, there are still some really good values out there for investors looking for a good deal on retail stocks.

This week we are going to examine the retail sector and see what kind of values we can turn up:

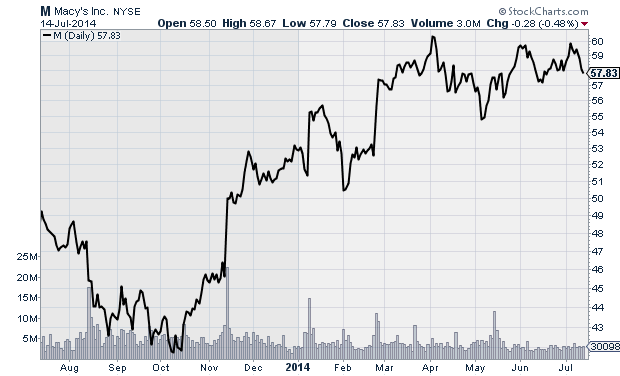

Macy's (M)

Department store chain Macy's (M) has been in a sideways pattern for the last few months, but over the course of the last year the stock has rewarded investors with some nice gains. The company has outpaced analyst estimates each of the last three quarters, and analysts have forecast earnings growth of 13% in 2015, which should help the stock break out of its current sideways pattern and trade up to new all-time highs. The stock currently has a P/E ratio of 14.7, which makes it a better value than rival Dillard's (DDS) which has a P/E of 16.5. I like the stock and believe the strong forecast earnings growth will drive the it higher and reward investors down the road.

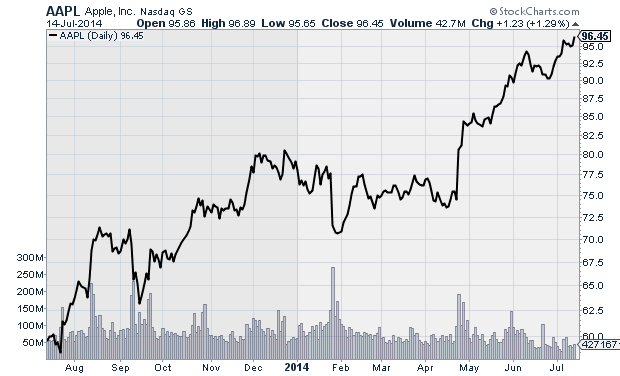

Apple Inc. (AAPL)

It is easy to think of Apple (AAPL) simply as a giant technology company, because in fact that is exactly what the company is, but it is also a major retailer. The company's retail stores have been pivotal in the company's return to power, and they will be of vital importance if Apple wants to maintain its dominant position moving forward. Apple stock has enjoyed solid gains over the last year, but its valuation remains attractive. Currently the stock is trading with a P/E of just 16, which is higher than it has been in recent years, but still low enough to warrant additional upside. Apple has a strong customer retention rate, with around 90% of its smartphone customers likely to buy another iPhone, which will help keep profits strong for the company moving forward. I continue to like the stock at the current valuation, and believe there is still value in AAPL shares.

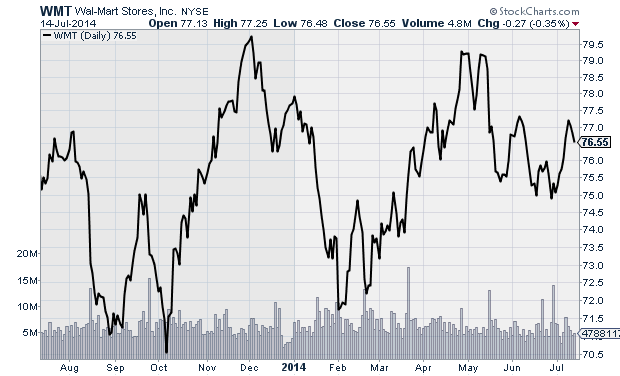

Wal-Mart Stores (WMT)

Wal-Mart (WMT) is synonymous with retail, with the company being not only the biggest retailer of general merchandise in the U.S., but the biggest grocery chain as well. Over the last year the stock has been stuck in a sideways trading pattern, but with its current valuation, I believe it will eventually be able to break out of its sideways pattern and trade higher. The stock currently has a P/E of 15.8, making it a compelling buy versus its biggest peers. Target (TGT) has a P/E of 20, and Costco (COST) is trading with a P/E of 26.2. WMT should benefit from improvements in the economy, and growing consumer confidence, and I believe that considering its current valuation there is value in the stock at the current time.

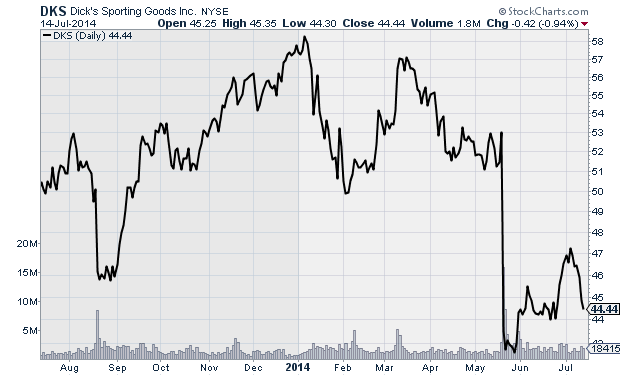

Dick's Sporting Goods (DKS)

Athletic goods retailer Dick's Sporting Goods (DKS) ran into trouble in May following a weaker-than-expected earnings report, but the recent sell off could has resulted in an attractive valuation for the stock. Its first quarter earnings of 50 cents per share were three cents lower than expected, but were still up from 48 cents during the same period last year. Analysts expect the company to grow earnings by 15% in 2015, which should push the stock higher. The recent drop in share price has resulted in a P/E ratio of just 16.2, which presents a good value to investors at the current time. The company has been experiencing weakness in its golf and hunting divisions, which could result in weak second quarter numbers, but that has already been priced into the stock, and once we pass the second quarter, golf and hunting take on a less important role for the company, and I believe the stock will trend higher through the second half of the year.

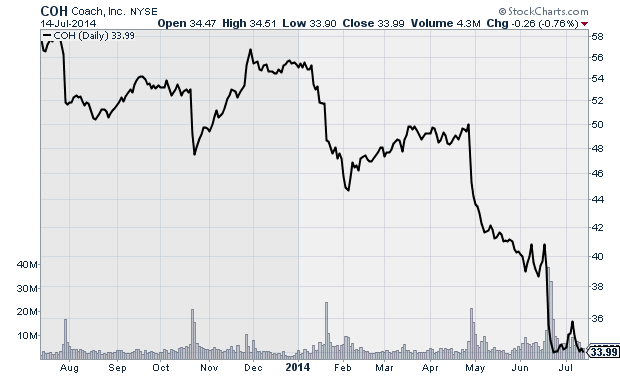

Coach, Inc. (COH)

The fashion industry can be fickle, and consumer tastes can change literally overnight. When this happens, you see a stock like Coach (COH), primarily known for its women's handbags and accessories, fall into peril. Over the last year, COH shares have taken a beating as a result of increased competition from companies such as Michael Kors (KORS). It has not been a great year for COH investors, but the recent sell off has created an interesting opportunity for traders looking for value in the retail sector. The stock is currently trading at a deep discount versus its peers, with a price-to-earnings ratio of just 10.3. This compares to a P/E of 26 for Michael Kors. Coach has recently shown strength in growing its sales in China by 25% last quarter, but its North American business has been waning. Coach is not for the weak of heart, but if the company is able to repair its U.S. business, and maintain its current international strength, the stock could quickly erase its recent losses and trade sharply higher.

Courtesy of MarketIntelligenceCenter.com