Dividend Aristocrats Outperform The Broad Market Over Past 5 & 10 Years

Dividend Aristocrats Outperform The Broad Market Over Past 5 & 10 Years

5 'dividend aristocrat' stocks set to boost earnings up to 77%

These companies help investors weather a shaky stock market

Companies that consistently increase dividend payouts tend to outperform the broader market in the long run.

To get a handle on which are the most attractive, we have identified a select list of companies with stellar track records for dividend increases that are also expected to produce double-digit growth of earnings per share over the next two years. Such stocks may help alleviate investors' worries, as the stock market rebounds from a 10% decline suffered in the past month.

The S&P 500 Dividend Aristocrats Index is made up of the 54 S&P 500 (SPX) (SPY) stocks that have raised dividend payouts for 25 consecutive years. Those aren't necessarily the best income plays, as the stocks' yields range from 0.56% to 5.43%. But the index has returned 122% over the past five years, compared with 102% for the broader S&P 500. For 10 years, those figures are 183% and 121%, respectively.

[BigTrends.com note: The author picks a few names below, but the actual stock holdings for the ETF that looks to replicate this Index are listed here: http://www.proshares.com/funds/nobl_daily_holdings.html ]

According to S&P Dow Jones Indices, "dividends have contributed nearly a third of total equity returns while capital gains have contributed two-thirds" since 1928. As you can see from the 5-year and 10-year returns above, that "third of total equity return" can really add up over time.

One excellent way to play the Dividend Aristocrats Index for a long-term investment is the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which seeks to mirror the performance of the index by holding all of the component stocks.

For investors looking to hold the individual stocks, here are the Dividend Aristocrats expected by analysts to produce the most growth in earnings per share over the next two years:

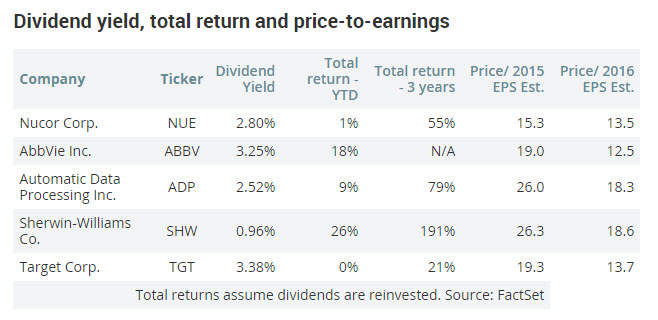

Here are the dividend yields, total returns and forward price-to-earnings information for the group:

The forward price-to-earnings ratios based on 2014 estimates are looking rather pricey for all of the stocks, except for Nucor. In comparison, the S&P 500 trades for about 15.1 times forward earnings. But for longer-term investors, the forward P/E ratios based on 2015 estimates are quite reasonable.

Over recent years, valuations for many fast-growing stocks, including Amazon.com Inc. (AMZN) and Twitter Inc.(TWTR) have been driven by expectations of continued market-share and revenue gains, while the companies haven't generated consistent profits. But earnings per share is a very meaningful figure for the Dividend Aristocrats, which keep making money and rewarding their shareholders, year after year.

Courtesy of MarketWatch