Global Bond Prices Are Falling (& Yields Rising)

Market Selloff That's Roiling Markets Around the World

Yields are surging amid worries of monetary withdrawal.

by Luke Kawa

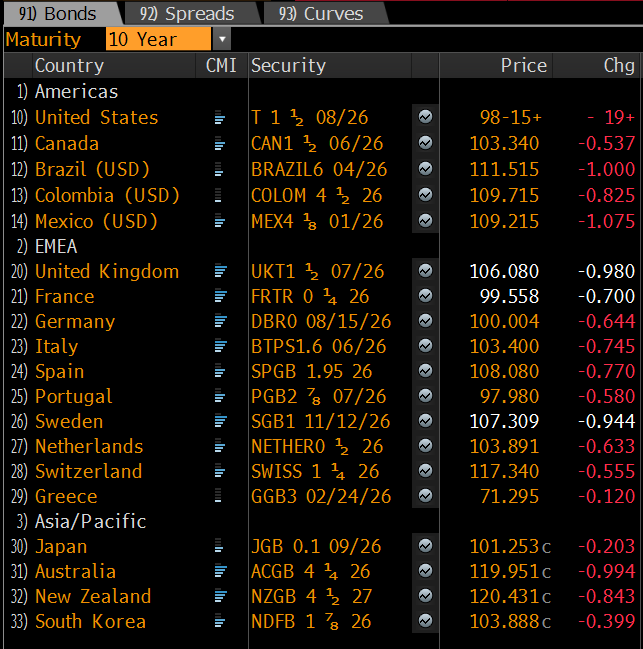

The story in markets this week: Bond prices have been Skyfalling, with yields on longer-dated sovereign debt in the world's largest economies jumping higher.

Some strategists have suggested that relatively lofty stock valuations are only justifiable in the context of ultra-low bond yields, so any price gyrations in sovereign debt aren't likely to stay confined to one market.

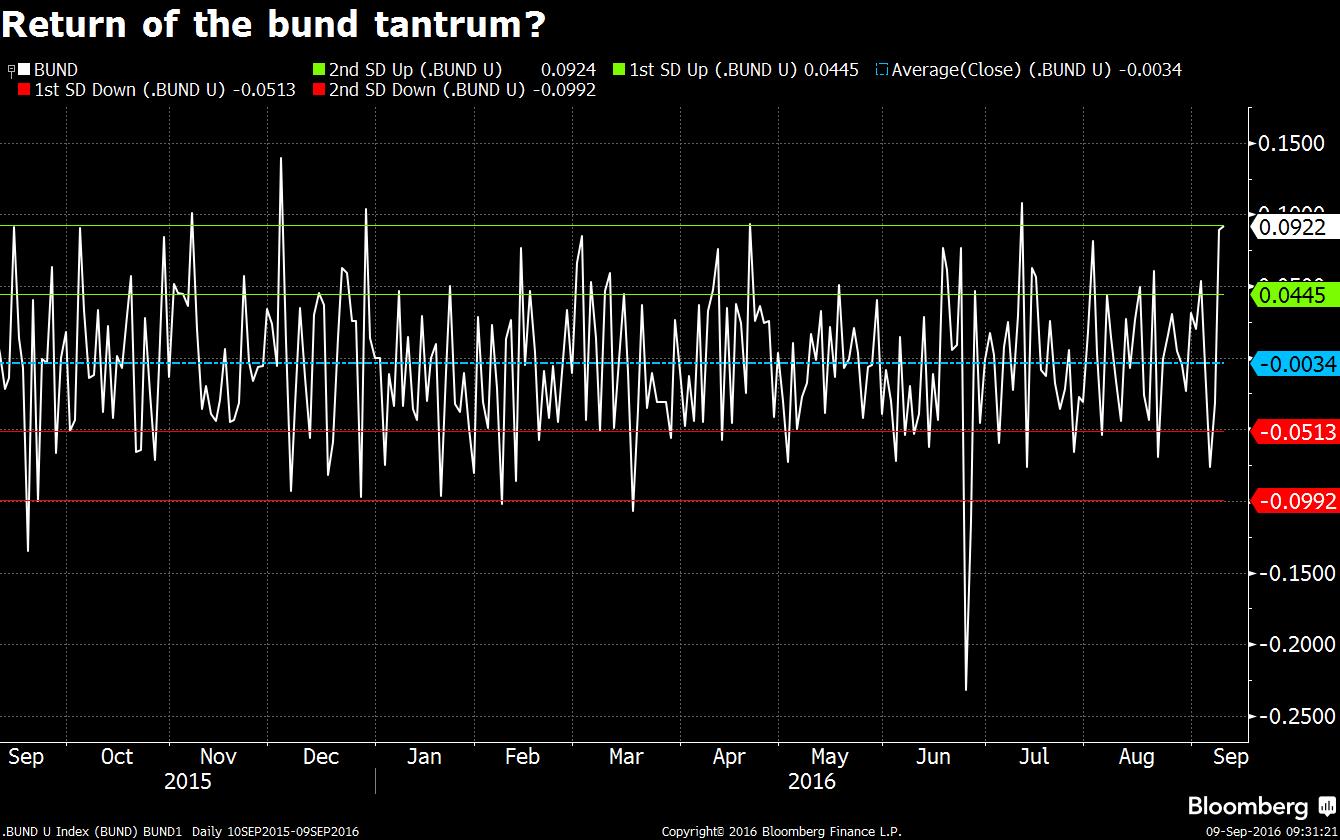

The abrupt moves in European and Japanese debt in recent days have evoked memories of the "bund tantrum" from the second quarter of 2015, which prompted Jefferies Llc Chief Market Strategist David Zervos to opine that markets had come down with a spring fever — Frühjahrsmüdigkeit — that was afflicting asset classes around the world.

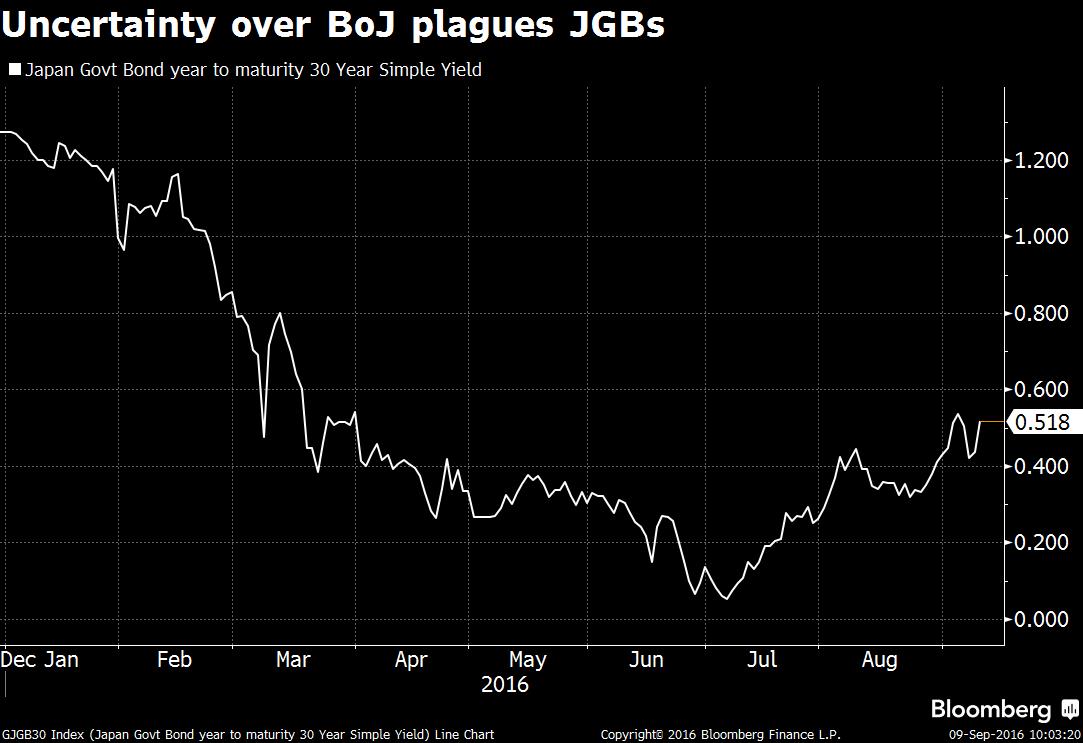

Worries that the Bank of Japan's "comprehensive review" of its monetary policy stance ahead of its September meeting might entail a reduction in its purchases of longer-dated sovereign debt sparked a rise in yields earlier in this month, one that has resumed in recent sessions. The yield on the 30-year JGB is now close to its highest level since March.

European bonds are similarly getting whacked after the European Central Bank elected to avoid adding stimulus or announcing an extension of its asset-purchasing program on Thursday. The yield on the 30-year German bund was up more than 9 basis points as of 9:30 am Eastern Time, roughly a two-standard deviation move.

The German 10-year yield broke into positive territory this morning for the first time since July 22.

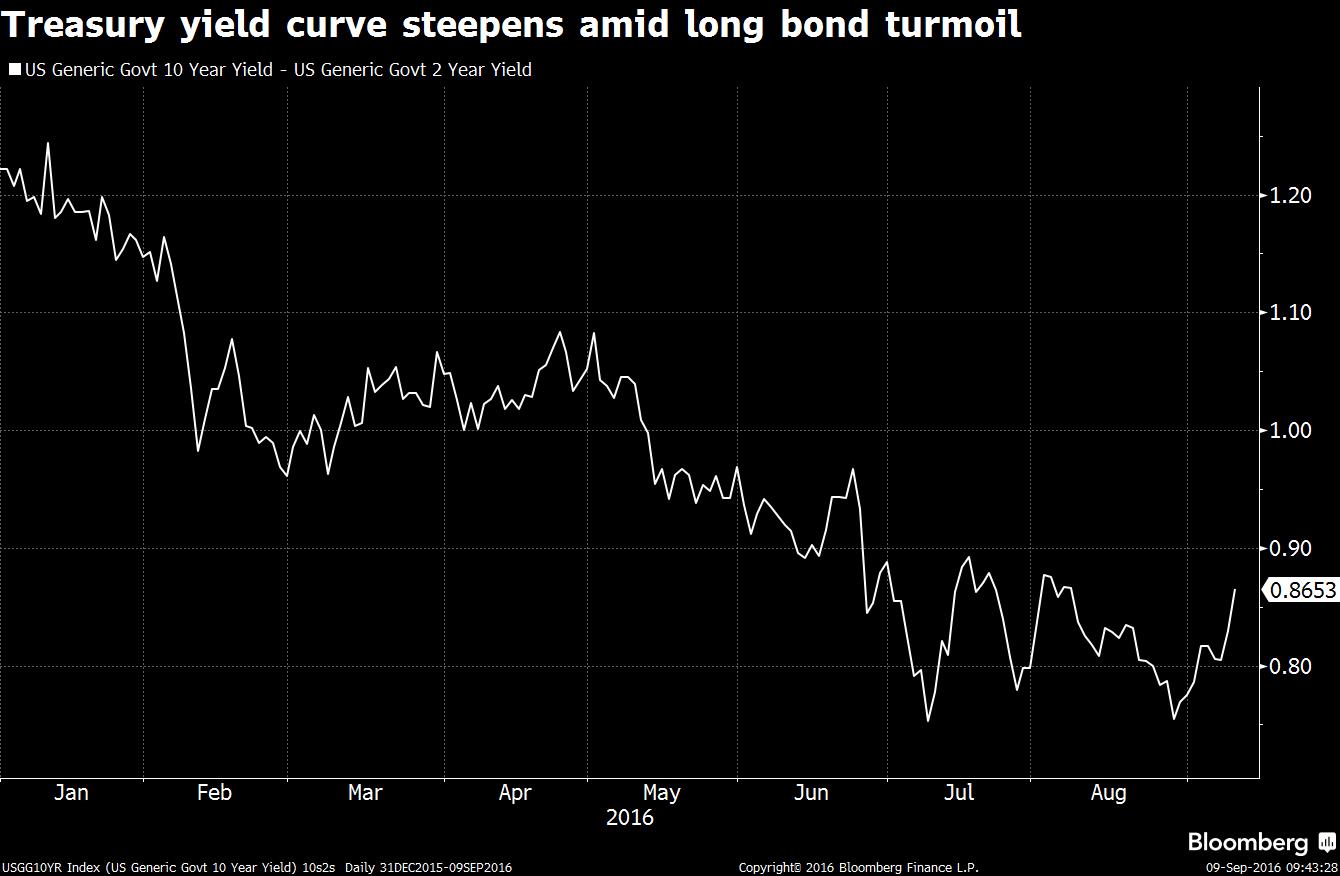

This recalibration on yields hasn't been driven by changing expectations of Federal Reserve policy. The implied odds of a U.S. rate hike in September are roughly where they were a week ago.

Nonetheless, the U.S. hasn't been immune from the back-up in rates. The yield curve — which had been flattening in earnest since the end of 2013 — has steepened notably in recent days, with the spread between two-year and 10-year Treasury yields (TLT) widening to near the top of its post-Brexit range.

Amid the global selloff in bonds, the yield on the U.K. 10-year government bond has retraced its retreat that followed the Bank of England's rate cut and enhanced asset purchasing program on Aug. 4.

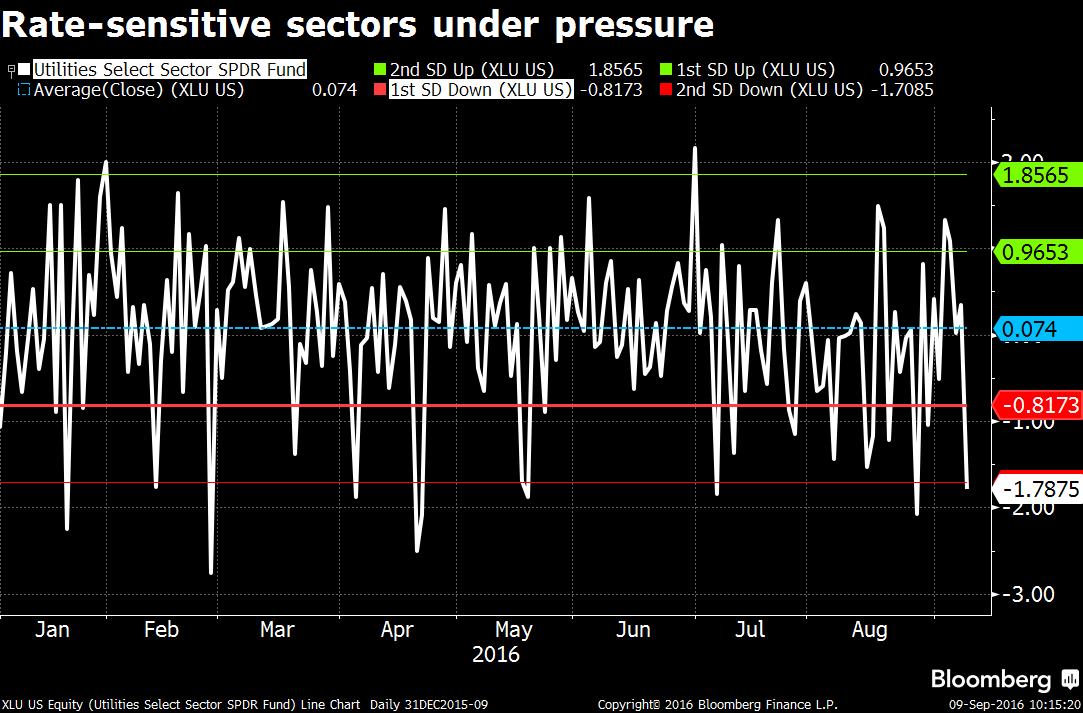

The bond rout is bleeding into other asset classes. If sustained, the decline in the Utilities Sector SPDR exchange traded fund (XLU) seen at 10:15 a.m. Eastern Time on Friday would constitute a two-standard deviation drop.

Rising yields on long bonds could spell trouble for one of the hottest investments strategies of 2016. A risk parity portfolio (which at its most basic, consists of a long, levered position in government debt and a long position in stocks) typically begins to underperform when sovereign debt prices fall, said Bank of America Merrill Lynch Head of Global Rates and Currencies Research David Woo.

Courtesy of bloomberg.com