Goldman Says No Fed Rate Hike Until 2016

Goldman's Crystal Ball: Rates Won't Rise Until 2016

In a note sent to clients this week, Goldman Sachs's team of economists laid out the case for why they think the Federal Reserve won't begin to raise rates until 2016. Their rationale boils down to two words: Janet Yellen, whose nomination to be the next chairman of the Fed has just occurred.

The Goldman Sachs (GS) economists point to a series of speeches that Yellen gave last year and what they refer to as her "optimal control" approach to the Fed's dual mandate of keeping employment high and inflation low. In essence, when Yellen talks about "optimal control," and she does a lot (here in Boston, again at Berkeley, and once more in New York), she's referring to a process whereby the Fed runs a series of simulations charting the effects of different monetary adjustments to figure out which one cuts unemployment the most, without kicking up too much inflation.

What the Goldman economists believe Yellen has settled on is a path that overshoots the goals of both. By leaving rates lower for longer, Yellen could max out the benefits to the labor market while allowing inflation to rise above the normal range considered in keeping with the Fed's mandate. In other words, Yellen seems willing to risk higher prices for the benefit of more jobs. At the heart of that bet is the fact that the Fed has been doing great on its inflation targets but poorly at ensuring full employment.

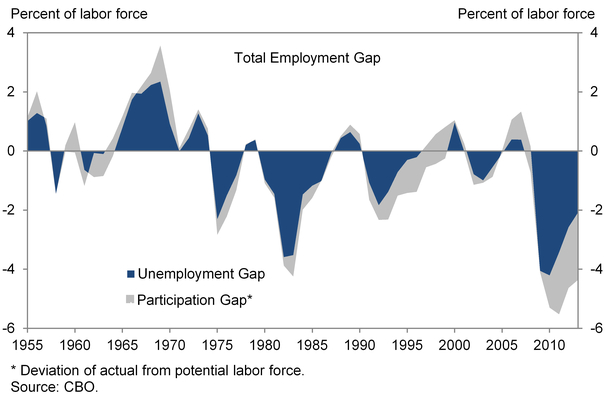

The employment gap is about 4 percent of the total labor force

According to both Goldman's estimate and one from the Congressional Budget Office, the amount of slack in the U.S. labor market right now amounts to about 5.7 million people, or about 4 percent of the total 144 million U.S. workers. That's about twice the size of the unemployment gap and factors in the falling participation rate and those workers who have simply stopped looking for jobs.

Again, Yellen seems willing to risk whatever negatives come from higher prices for the benefits that come from dragging those people back into the labor force. She's betting that after four years of low inflation rates, a year or two of higher-than-normal price increases wouldn't be such a shock; prices would still be relatively low, and businesses would finally be able to raise their prices.

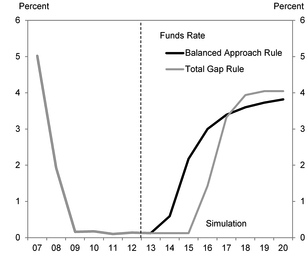

Goldman thinks the Fed Funds rate will stay near zero until 2016

That in turn would goose short-term consumer spending, as all feel compelled to buy things today rather than waiting until tomorrow when prices are higher. That would address one of the biggest problems behind the slow growth of the past four years: weak demand. With the savings rate back around 4.6 percent, household balance sheets are much healthier than they were just a few years ago.

If Goldman is reading the tea leaves correctly, and it tends to better than anybody, that means the Fed funds rate would effectively be zero for more than 7 years, from late 2008 to early 2016.

Courtesy of Matthew Philips, businessweek.com