Has The Fed Lost Control Of The Dollar?

While Federal Reserve Chair Janet Yellen plays Hamlet over the question of when and by how much to raise the Fed Funds interest rate, she seems oblivious to the fact that the Fed Funds rate has become irrelevant to what matters most about monetary policy-the real value of the dollar. Since the end of June, the Fed Funds rate has gone nowhere, while the real value of the dollar (UUP) has increased by 11.0% in terms of the CRB Index* (CRBQ), and by 9.3% vs. gold (GLD).

It is accurate to say that dollar monetary conditions have "tightened" since the end of June. "Tight money" simply represents a monetary environment that is forcing commodity prices and NGDP lower than the market expected, while "loose money" is the opposite. The Fed Funds rate means nothing. It is possible to have a Fed Funds rate of 0.11% and extremely tight money (as we had in October 2008), or a Fed Funds rate of 9.93% and extremely loose money (as we had in July 1980).

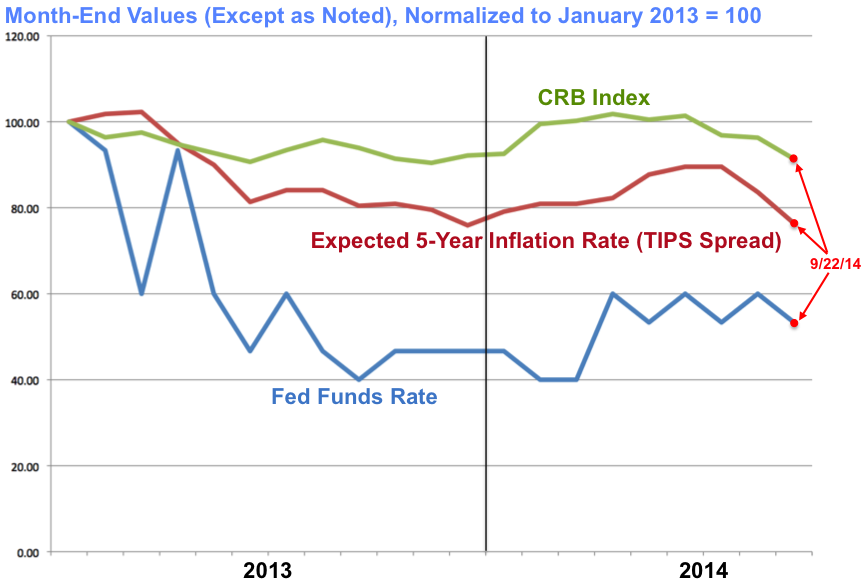

The Fed Funds Rate vs. the Real Value of the Dollar Chart

Each millisecond, commodity prices and market interest rates reflect all known information, and the prices at any given moment fully embed the market's expectations about the future. "Tighter money" simply represents a monetary environment that is forcing commodity prices and NGDP lower than the market had expected, while "looser money" is the reverse of this.

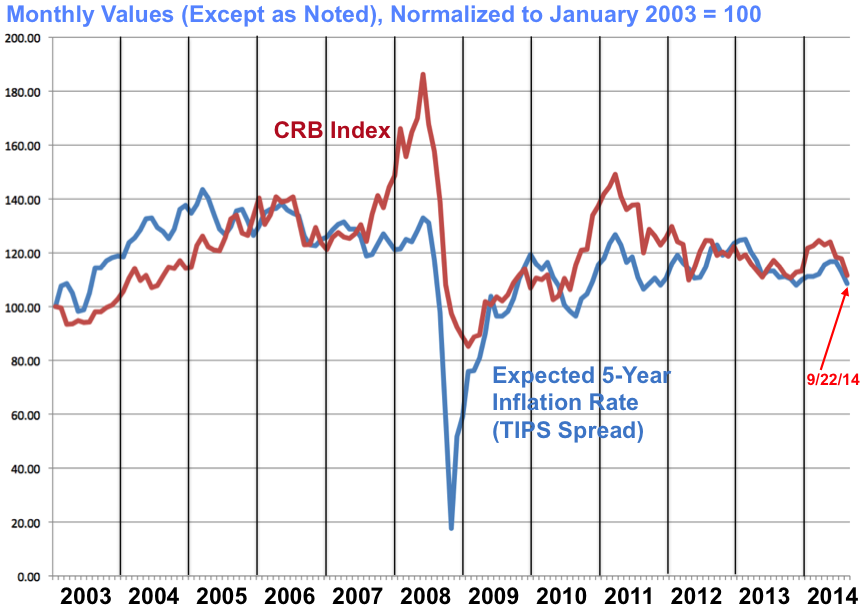

As one would expect, there is a very tight correlation between movements in the CRB Index and changes in expected 5-year inflation, as measured by the interest rate spread between 5-year Treasuries and 5-year TIPS.

Expected 5-Year Inflation vs. the CRB Index Chart

Money has not only gotten tighter in the U.S. since the end of June, it has gotten tighter pretty much everywhere. Against the CRB Index, the value of the euro, British pound, and Japanese yen have gone up 4.23%, 6.26%, and 3.39%, respectively. The difference between these numbers and the 11.00% rise in the real value of the dollar reflects an increase in the dollar's foreign exchange value.

Given the data, it is endlessly amazing that anyone still believes that, "a weak dollar benefits the economy by boosting exports." From the end of June to September 22, the Dow Jones Industrial Average rose by 2.14%. This equates to an 11.63% increase in the real value of the Dow in terms of gold, and a 13.38% increase vs. the CRB Index.

The markets believe that the stronger dollar has been a good thing thus far, but it is possible to have too much of a good thing. Our highly leveraged financial system simply cannot tolerate a large amount of deflation. It would be best if the Fed were to simply start using its Open Market operations to stabilize the CRB Index at its current level.

It is actually a little scary that the real value of the dollar has gone up by 11.00% (vs. the CRB Index) while the Fed has been fixated on what to do with its completely irrelevant Fed Funds target rate. Right now, the dollar is showing early signs of running away into deflation, despite a stable effective Fed Funds rate.

Earth to Janet Yellen: Stop worrying about interest rates and focus on the real value of the dollar.

*The CRB Index is a commodity price index comprising: Aluminum, Cocoa, Coffee, Copper, Corn, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Nickel, Orange Juice, Silver, Soybeans, Sugar, Unleaded Gasoline, and Wheat.

Courtesy of Forbes.com