Is India Poised For More Outperformance In 2015?

Is India Poised For More Outperformance In 2015?

William Blair: India Is A Top Emerging Market Investment In 2015

The 2015 Global Market Outlook by William Blair (full PDF report is here) focused on investing in the modern non-inflationary world. Despite the current environment of deflation, analysts believe that there are still areas of growth to be found for picky investors. The report focused on one such investment opportunity: emerging markets.

Macroeconomic Restructuring

During the past decade, many emerging market countries have undergone major fiscal policy changes that have solidified their economies and laid the foundation for sustainable growth. New policies reigning in out-of-control inflation, cutting irresponsible fiscal spending and reducing or eliminating debt inevitably created much healthier business environments.

From 1997 to 2014, the number of high-quality emerging market companies that William Blair includes in its investable universe has risen seven-fold. In fact, there are now as many high-quality emerging market names in the William Blair's universe as there are U.S. companies.

India

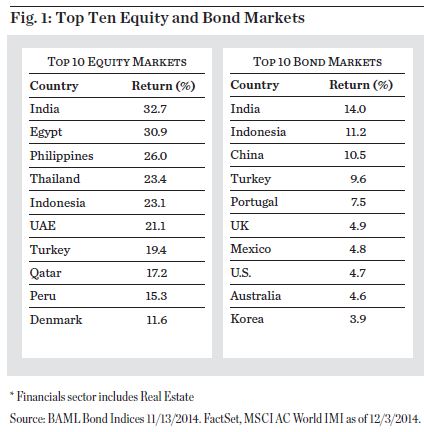

The poster child for investment in modernized emerging markets in 2014 was India (EPI) (PIN). India's equity market was the best-performing market of 2014, gaining 32.7 percent on the year. In addition, India's 14 percent bond yield topped William Blair's list by a wide margin.

2014 Market & Bond Performance Table

William Blair analysts believe that India's largest concern for the future will be attracting sufficient investment capital. "Although inflation fell noticeably in the second half of 2014, Reserve Bank of India Governor Raghuram Rajan has yet to cut interest rates," the report stated.

"Rajan's actions suggest that the government is serious about reigning in inflation to pave the way for productive investment and growth."

Despite the surge in stock prices, analysts believe that India's relatively low average stock valuation of 15.2 leaves plenty of room for upside.

Courtesy of Benzinga