Is It Time For India, China, Brazil?

The birth of three new bull markets

Emerging markets around the world have sorely underperformed the U.S. markets over the last three to five years, but a turn appears to be taking place, and it may be time for investors to jump on board.

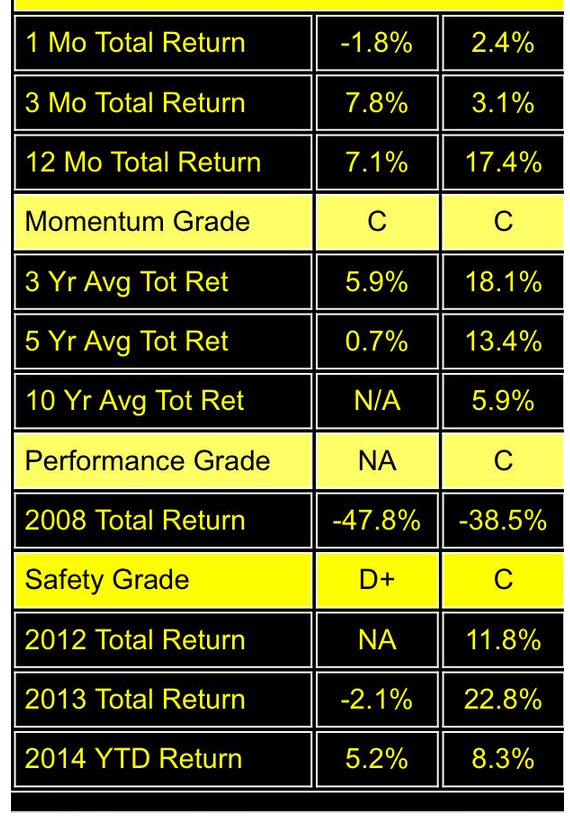

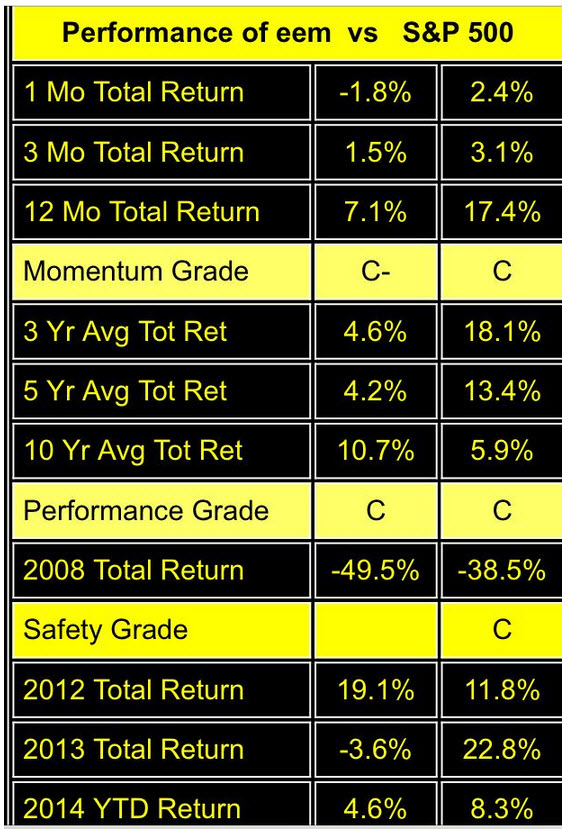

With regard to their lagging the U.S., it's not surprising. They did not have the performance-enhancing stimulus in their system that our markets did. Just look at the difference in performance between our S&P 500 and the Emerging Market Index ETF (EEM), -0.28% over the last three and five years, trailing by 13.5% per year over three years and 9% per year over five years.

Performance data from Best Stocks Now app

But that trend has reversed this year, and emerging markets are now beginning to outpace the U.S. market. It would appear that three new bull markets could be emerging in India, Brazil and China.

India

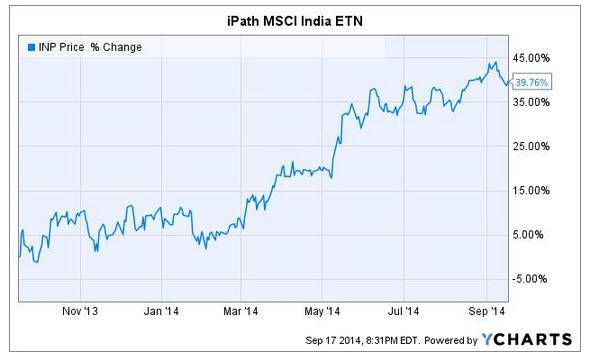

Economic stimulus can stoke the market fire, but so can political change. New leaders are usually elected because the previous ones did not do a very good job. That is exactly what we are seeing in India right now - using the iPath MSCI India ETN (INP), as our representative. [BigTrends.com note: EPI & PIN are two other India ETFs.]

India is currently my favorite emerging market. Political change has taken place, and there is hope that the new leadership can lead the economy out of the doldrums it has been in for several years.

India's market has been left behind over the last five years after being one of most promising markets at the turn of the millennium. Look at the performance of the India MSCI Index ETF (INDA), over the last 12 months. It is up more than 35%.

Welcome back, India. I continue to increase my exposure to India, as this market's resurgence still appears to have a ways to go. India is a lot earlier in their economic recovery than we are here in America, which is something to think about.

China

China is another market that has underperformed the U.S. market by a wide margin over the last three to five years. Just look at the performance of the China 25 Index ETF (FXI).

I am always worried about the quiet guy in a game of poker. China has always been very quiet about what they are up to. The lender is usually smarter than the borrower. The borrower is beholden to the lender. If the lender wants the borrower to pay up, he can make all kinds of demands. He is negotiating from strength, while the borrower's position is weak. For now, China continues to lend us all of the money that we want.

China is another emerging market that is beginning to wake up, although it still trails the U.S. market this year, check out the performance over the last three months. China intends to be a major player in the world economy going forward and it will do what is necessary to make that happen.

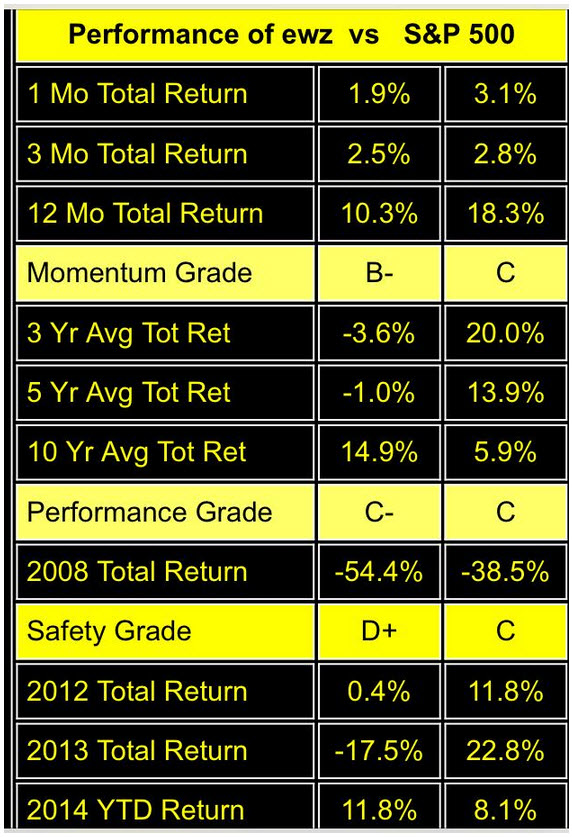

Brazil

Brazil is another market that has languished the last few years under the cloud of political corruption and mismanagement. The regime in Brazil has been horrible for their economy and for their market.

Brazil's elections are coming up on Oct. 5. The market there has been trading up on the hope for economic reform and is up almost 12% year-to-date. But given that the outcome of the election is uncertain, this bull market is the riskiest of the three scenarios mentioned. One way I am playing the rally in Brazil is through exposure to Brazilian energy stock Petrobras (PBR). [BigTrends.com: EWZ is a liquid Brazil ETF.]

Historically, emerging markets like India, China and Brazil have been more volatile than the U.S. market. So the safest way to play these emerging-market bulls is to spread your money around many of them. I am doing this through the thinly traded BLDRS Emerging Markets 50 ADS Index Fund ETF (ADRE).

As the bull-market cycle in the U.S. approaches its 66-month anniversary, I am looking for the next bull markets. I think I have found three of them in India, China, and Brazil.

Courtesy of MarketWatch.com