Best & Worst Performing Blue Chip Stocks This Earnings Season

Best & Worst Performing Blue Chip Stocks This Earnings Season

Also, An Overall Earnings Day Performance Snapshot

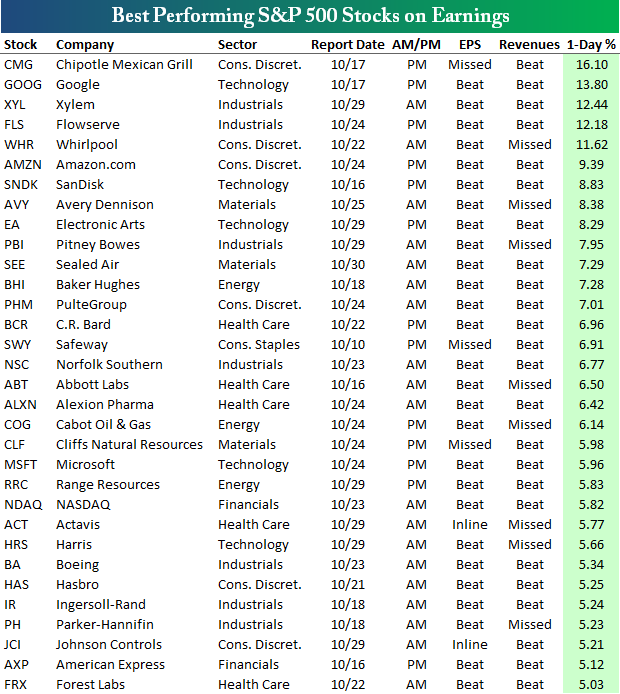

Below we highlight the best and worst performing S&P 500 stocks on their report days this season.

As shown, Chipotle Mexican Grill (CMG) ranks first with a one-day gain of 16.1% on its report day. Tech-giant Google (GOOG) ranks second best with a one-day gain of 13.8%, which moved it up to its current valuation of $345 billion. Xylem (XYL), Flowserve (FLS) and Whirlpool (WHR) round out the top five with one-day gains of more than 10%. Other notable names on the list of earnings season winners in the S&P 500 include Amazon.com (AMZN), Electronic Arts (EA), PulteGroup (PHM), Microsoft (MSFT), Boeing (BA) and American Express (AXP)

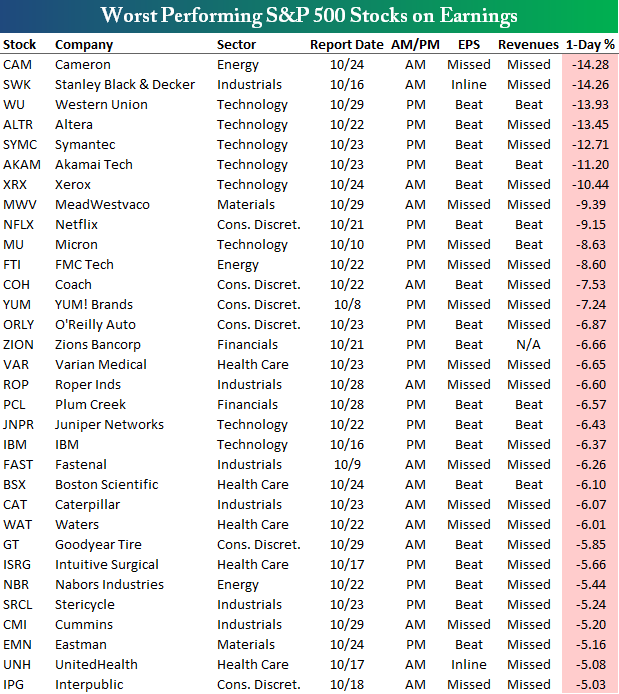

Cameron (CAM) and Stanley Black & Decker (SWK) are at the top of the list of earnings season losers. Both of these stocks declined more than 14% on their report days recently. Western Union (WU), Altera (ALTR), Symantec (SYMC), Akamai Tech (AKAM) and Xerox (XRX) all posted one-day declines of more than 10% on their report days as well.

Netflix (NFLX) is also on the list of losers with a one-day decline of 9.15% on 10/22. Even though the stock reported an earnings 'triple play' (beating on EPS, evenues and raising guidance), the stock still sold off sharply because, in hindsight, expectations heading into the report were through the roof. Other notables on the list of S&P 500 earnings season losers include Coach (COH), Micron (MU), IBM, Caterpillar (CAT), Intuitive Surgical (ISRG) and UnitedHealth (UNH).

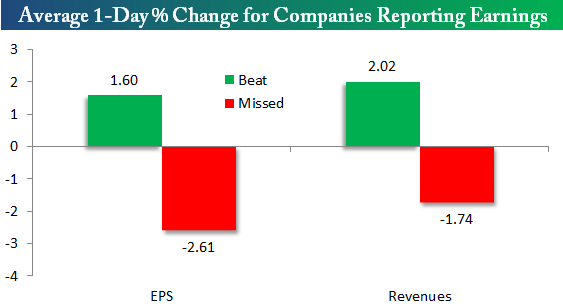

For the overall market, here is a snapshot of how stocks fared on the day of earnings, broken down by whether exceeded or missed EPS and Revenue expectations:

The average stock that has missed earnings estimates has declined more than the average stock that has missed revenue estimates, which also makes sense given that the earnings beat rate is higher than the revenue beat rate.

So far this season, investors are rewarding the companies that beat revenues and selling companies that miss earnings.

Courtesy of bespokeinvest.com