Bank of America (BAC) Hits New Highs on Q4 Results

Despite falling short of revenue expectations last quarter, and back-sliding on one key measure, Bank of America (BAC) has pressed into new 52-week high territory on Friday following the release of its fourth quarter numbers.

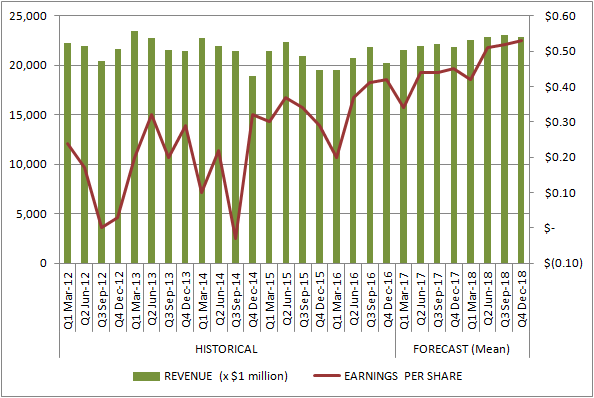

For the quarter ending in December, earned 40 cents per share on revenue of $20.0 billion. Those figures were up 48% and 2.2%, respectively, on a year-over-year basis, when BofA reported a profit of 27 cents per share on a top line of $19.56 billion. Earnings topped expectations of 38 cents per share, though the same pros were calling for a top line of $20.96 billion.

All the same, BAC investors (current and prospective) saw the glass as half full rather than half empty. BAC shares advanced 1.7%, reaching a new multi-year high in the process.

As was widely hoped/expected, higher interest rates helped the bank become more profitable.

The company noted in October that a 100 basis point rise in interest rates could add as much as $7.5 billion in annual net income, as the difference between the cost of money and lending that money widens. Those interest rates -- long-term and short-term -- grew approximately 60 basis points during the quarter in question. Though they didn't meaningfully rise until the quarter was halfway over, it was still enough to spur a 6% increase in net interest income -- to $10.3 billion -- for the quarter in question. Loan balances were up 2.0%.

It wasn't just a more favorable interest rate environment that boosted the bottom line though. The rip-roaring quarter for stocks that was spurred by a surprising (and bullish) outcome of the Presidential election sent traders into something of a frenzy. Fixed income trading revenue was up 12%, and equity trading revenue grew 7%. The combination of the two generated $2.8 billion worth of revenue.

The one sore spot may have been the banks return on tangible common equity, or 'ROTCE' for short. Bank of America has been aiming for a ROTCE reading of 12%, and managed to grow that figure to 10.3% in Q3. For the fourth quarter though, it peeled back to only 9.9%.

Still, some would say Bank of America is slightly too well capitalized, and has more common equity that it needs, artificially pushing the number lower.

It wasn't a concern on Friday, though, as investors determined that the forward-looking P/E of 14.0 was not only palatable, but likely to underestimate the bank's 2017 results. BAC shares are overbought and ripe for a pullback.... quite a bit, actually. In light of the underlying fundamentals though, any sizeable pullback is apt to be met with an equally sizeable rebound.

If you'd like to capitalize on these responses to earnings announcements, become a subscriber to our Earnings Extravaganza newsletter.