FedEx is flashing a bearish technical sign ahead of earnings, according to chart

FedEx shares were on the move after Cowen reiterated its outperform rating heading into the peak holiday shipping season.

But, the stock has not delivered in recent months. The shares have fallen 13% this quarter, tracking for their worst since March 2020. This comes ahead of earnings next Tuesday.

Bill Baruch, president of Blue Line Capital, sees a warning forming in the charts.

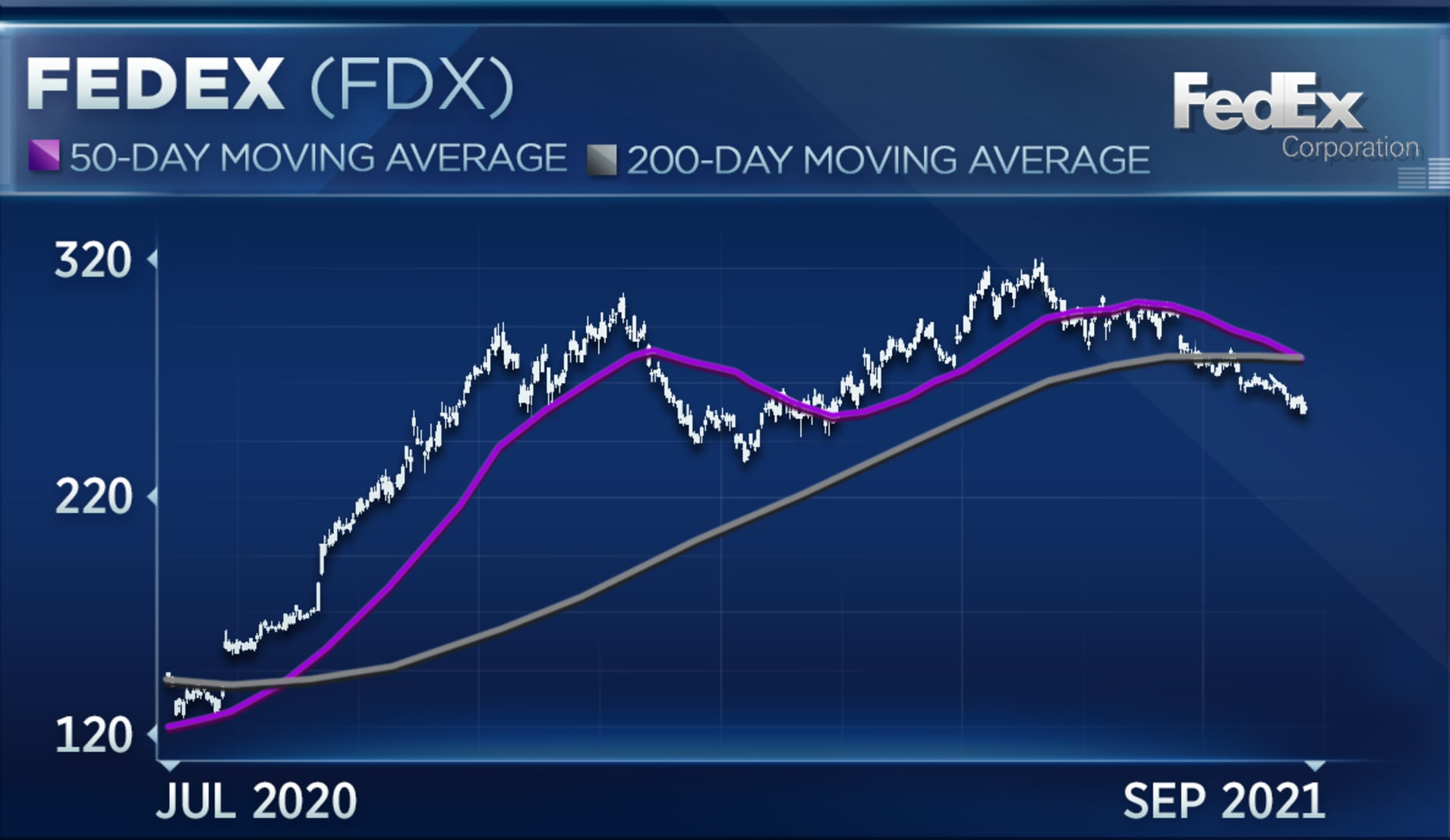

"The FedEx stock is actually trading well below its 50-day moving average and you're seeing the death cross here," Baruch told CNBC's "Trading Nation" on Wednesday. "On top of that, FedEx has now surrendered its 2018 high. This stock on a charting basis is very exhausted at these levels."

A death cross is formed when a shorter-term moving average, typically the 50-day, moves below a longer-duration moving average such as the 200-day. This bearish indicator suggests more downside to come.

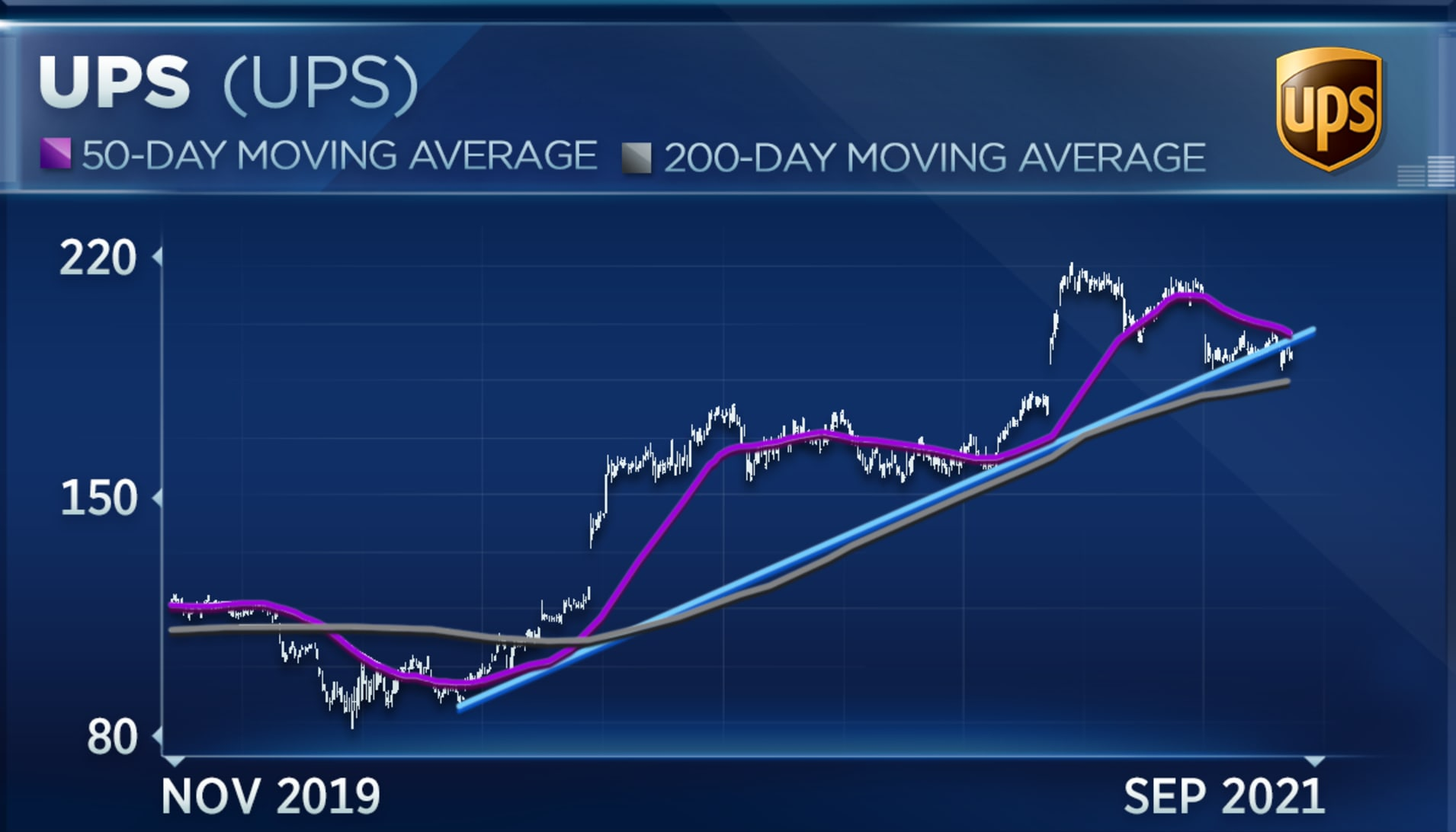

Main competitor UPS is in similar shape, Baruch said.

"We owned UPS for a while and UPS had a great surge back in late April after earnings but it wasn't able to hold that and it left another gap down as well ... and now breaking a trend line going back to May of last year. So I think UPS and FedEx are both looking very exhausted and I think there could be lower to go," he said.

The positives in FedEx balance out the negatives, though, according to Gina Sanchez, CEO of Chantico Global and chief market strategist at Lido Advisors.

"There's a lot of upside from here but the environment is a challenge so FedEx has some positives and negatives. The positives are that they made a huge investment into capacity going into the holiday season. Some of the downs are that UPS is getting into the same-day space so more competition. But their valuation says there's upside from here," Sanchez said during the same segment.

She added that downside revisions to earnings growth and a resetting of expectations that have impacted the broader market have affected FedEx.

"The environment is just not great even though FedEx is not expensive. I think it's actually cheap here and could be an interesting buy but it's going to have a lot of volatility," Sanchez said.

From CNBC